Framework for ESG Investments / Investment Examples

◆For more detailed information on our ESG investments and stewardship activities, please refer to the "Responsible Investment Report."

Framework for ESG Investments

Our ESG investment efforts are focused on the items listed below.

ESG Integration

Having introduced ESG integration for all assets under management, we comprehensively evaluate and use financial information as well as ESG factors. In making investments and loans, we integrate a method that takes each asset's characteristics into account so as to comprehensively evaluate the ESG initiatives of the investee and incorporate these into our decision-making process.

We have also measured and analyzed the greenhouse gas emissions of our entire portfolio and for each investees, and use the findings to engage with (have constructive dialogue with) carbon intensive sectors and investees to reduce emissions and, finally, to make investment decisions.

In addition, we have established criteria for negative screening in order to resolve ESG issues and realize a sustainable society.

In-House Management

Sovereign Bonds

- We incorporate ESG factors into investee credit evaluation processes.

- When making investment decisions and during monitoring, we consider investments after an evaluation of the investee's ESG factors with reference to scores of external ESG ratings.

- When making ESG-themed investments, we invest in projects that can broadly contribute to the achievement of the SDGs and the resolution of issues, after checking how funds will be used and project feasibility.

- We conduct impact assessments for ESG bonds in which we have invested with the intention of contributing to the resolution of environmental and social issues.

- *

- Our approach to impact assessment is described in the Responsible Investment Report.

Corporate Bonds

- We incorporate ESG factors into investee credit evaluation processes.

- When making investment decisions and during monitoring, we consider investments after an evaluation of the investee's ESG factors with reference to scores of external ESG ratings.

- When making investment decisions, we assess and consider investee companies' responses to climate change, including their efforts to reduce greenhouse gas emissions.

- We evaluate the status of investee company ESG initiatives through dialogues with them and by utilizing the information obtained therein.

- When making ESG-themed investments, we invest in projects that can broadly contribute to the achievement of the SDGs and the resolution of issues, after checking how funds will be used and project feasibility.

Japanese Municipal Bonds/Loans

- We consider ESG factors when selecting municipalities for investment, loans, or dialogue.

- Specifically, when selecting municipalities for investment, loans, or dialogue, we regularly check their ESG initiatives, such as certification under the Zero Carbon City (*1) and SDGs Future City (*2) programs.

- We evaluate the ESG initiatives of municipalities for investment or loans through regular dialogues with them and by utilizing the information obtained therein.

- We invest in SDG bonds with the aim of contributing to the sustainable growth of local communities.

- (*1)

- As announced by the Ministry of the Environment, a "zero carbon city" is one where the municipality or its chief executive has announced that the municipality aims to reduce greenhouse gas emissions or CO2 emissions to net zero by 2050.

- (*2)

- The Cabinet Office selects municipalities proposing outstanding initiatives for the achievement of the SDGs as "SDGs Future Cities."

Project Finance

- We incorporate ESG factors into the credit evaluation processes for investees and loan recipients.

- We check environmental impact and other factors when assessing potential investments or loans before making decisions on each.

- We do not invest additionally in coal-fired power generation projects regardless of location because those emit a large amount of CO2, and we are concerned about an impact on climate change.

Listed Equities

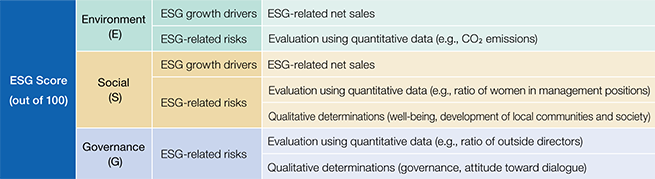

- We use our unique ESG scoring approach to evaluate equity portfolios.

- ESG scoring method:

Items that affect future cash flow and cost of capital are extracted and evaluated for each of the three ESG elements of environment (E), social(S), and governance (G). - The following two types of funds are managed with consideration of this ESG score:

Dividend funds: Investment in high-dividend companies expected to increase their corporate value over the medium to long term, based on a comprehensive evaluation of the company's ESG initiatives in addition to its financial information

Growth funds: Investment in companies using ESG as a growth opportunity, evaluating their contribution to business performance and growth potential with regard to technological capabilities and business infrastructure contributing to achieving the SDGs and solving issues, while considering financial information

- *

- Our efforts toward ESG integration in equities are described in the Responsible Investment Report.

Externally Managed Assets

- When selecting and monitoring investment managers, we check their ESG investment initiatives (policies and attitudes toward ESG, specific ESG investment approaches, etc.) and take these into consideration when making investment decisions.

- When deciding whether to invest in externally managed funds, we consider the specifications of the eligible funds and check whether their negative screening and other efforts to exclude specific businesses are appropriate in light of Japan Post Insurance's negative screening criteria.

Engagement and Exercising Voting Rights

We accurately understand the conditions of investees to engage constructively with them. While building relationships with investees, we ask disclosure of not only financial information but also non-financial information, including ESG elements to confirm their initiatives for ESG issues, etc.

For externally managed assets, we hold regular meetings on stewardship activities with investment managers and check engagement initiatives by asset managers with investee companies, taking characteristics of each asset into account.

Our voting activities are based on our Policies on the Exercise of Shareholders' Voting Rights.

When voting, we take into consideration non-financial information, including ESG factors, and information gained from dialogues with companies.

Japan Post Insurance has accepted Japan's Stewardship Code and has established Company policies in accordance with it.

See "Stewardship Activities" for details.

ESG-themed Investments and Impact Investments

We proactively engage in ESG-themed investments and impact investments* centered on "warmth" and founded in our priority initiative themes of "enhancement of well-being," "development of local communities and society," and "contribution to environmental protection." We invest in projects which can widely contribute to the achievement of the SDGs and the resolution of issues upon confirmation of feasibility and limitation of use of funds.

Please see "Major ESG Investment examples" for information on our investment cases.

We have established a unique framework to promote impact investment, including the internal certification of projects that fulfill certain conditions, such as the ability to set quantitative metrics linked to generating an impact as KPIs, under the Impact "K" Projects.

Please see Promoting the Impact "K" Projects for details of the Impact "K" Project.

- *

- Impact investments mean investment activities intended to generate positive and measurable social and environmental impact in parallel with financial returns.

Negative Screening

We make the following efforts in order to solve ESG issues and realize a sustainable society.

- We do not invest in companies that manufacture controversial weapons (Cluster weapons, Anti-personnel mines, Biological weapons and Chemical weapons) due to indiscriminate serious damage on civilians.

- We do not invest additionally in coal-fired power generation projects regardless of power generation efficiency or location because those emit a large amount of CO2, and we are concerned about an impact on climate change.

Promoting the Impact "K" Projects

We proactively engage in impact investments (*1) , projects taking account of our priority initiative themes.

To expand our investment in and lend more money to impact-driven projects, we have established the Impact "K" Project, an impact investment certification framework uniquely defined by Japan Post Insurance. In order to fulfill our fiduciary responsibility to our clients, we will promote impact investment after having carefully examined the impact investment structure, strategy, track record, selection and management status of investees, and IMM (*2) of the management company to whom we entrust the investments.

<Authorization of Impact "K" Project ・ Examples>

- Investment in real estate fund whose main tenants are licensed nursery schools in urban areas with a large number of children on waiting lists (March 2022) (in Japanese)

- Investment in a fund that aims to achieve both social and economic returns by investing in domestic companies that are actively engaged in generating a social impact (May 2022) (in Japanese)

- Investment in companies that solve social issues and funds that seek the development of a sustainable Japanese society in which people have a high degree of well-being and live in harmony with the environment (July 2022)

- Investment in a fund that seeks to "improve wellness literacy" and "enhance social capital," which we believe are leverage points for achieving wellness equity (August 2023)

- Investment in a fund that aims to achieve both social and economic returns by investing in medical and health fields and digital technology fields originating in academia (October 2023) (in Japanese)

Please refer to the Responsible Investment Report for the Impact "K" Project authorization flow and investment examples.

- (*1)

- Impact investments mean investment activities intended to generate positive and measurable social and environmental impact in parallel with financial returns.

- (*2)

- Impact Measurement and Management.

Initiatives for Academic-industrial Collaboration

Out of our belief that contributing to the development of educational systems and advanced research at universities will be beneficial in helping to solve various social issues, we have committed to industry-academia collaboration in the area of asset management.

| Building a framework for cooperation and collaboration with universities | We signed a memorandum of understanding for collaboration and cooperation to actively promote investment in innovative technological developments and businesses held by academia. Currently, we are discussing funding for venture companies that utilize research results from universities, with a focus on the area of impact investment.

|

||||

|---|---|---|---|---|---|

| Holding lectures at universities | To contribute to the development of financial professionals, we give lectures on ESG investment at universities. For more information about this initiative, please read about our "Social Contribution Activities." |

In addition, we invest in sustainability bonds and social bonds issued by university corporations for the purpose of education and research development.

| May 2023 | Tokai National Higher Education and Research System | Sustainability bond "THERS Commons Bonds" |

|---|---|---|

| January 2023 | Tohoku University | Sustainability bond "Tohoku University Future Creation Bonds" |

| December 2022 | Tokyo Institute of Technology | Sustainability bond "Tokyo Institute of Technology Tsubame Bonds" |

| October 2020 | The University of Tokyo | Social Bond "University of Tokyo FSI Bonds" |

Major ESG Investment examples

We make ESG-themed investments taking ESG factors into account. We invest in projects that can broadly contribute to the achievement of the SDGs and the resolution of issues, after checking their feasibility and that the funds usage is limited.

Investment in ESG bonds

| Investments | Main Relevant SDGs |

|---|---|

|

Investment in Blue Bonds issued by the Republic of Indonesia (May 2023)

|

|

|

Investment in a transition bond to support efforts to reduce greenhouse gas emissions (July 2021)  © Nippon Yusen Kabushiki Kaisya |

|

|

|

|

|

|

|

|

Investment in a Sustainable Development Bond to support the purchase and distribution of vaccines through the international framework "COVAX" (March 2021)  © Inter-American Development Bank |

|

|

|

|

© European Bank for Reconstruction and Development |

|

|

Investment in a Sustainable Development Bond in response to the COVID-19 (May 2020)  © Inter-American Development Bank |

|

|

Investment in a Sustainability Awareness Bond to fight against COVID-19 (May 2020)  Community of Madrid © European Investment Bank |

|

© European Investment Bank |

|

|

Investment in a Social Bond themed Feed Africa to increase food production on the African continent (May 2018)  © African Development Bank |

|

|

Investment in a Sustainable Development Bond to Raise Awareness of Health and Nutrition of Women, Children, and Adolescents (May 2018)  ©World Bank |

|

|

Investment in a Thematic Bond promoting gender equality (May 2018)  © Asian Development Bank |

|

Investment in Renewable Energy Businesses

| Investments | Main Relevant SDGs |

|---|---|

|

Investment in renewable energy projects such as solar power generation and biomass power generation (project finance) (since 2017)

|

|

Investment in funds

| Investments | Main Relevant SDGs |

|---|---|

|

Investment in a fund that aims to achieve both social and economic returns by investing in medical and health fields and digital technology fields originating in academia (October 2023)

|

|

|

Investment in a fund that seeks to "improve wellness literacy" and "enhance social capital," which we believe are leverage points for achieving wellness equity (August 2023)

|

|

|

Investment in companies that solve social issues and funds that seek the development of a sustainable Japanese society in which people have a high degree of well-being and live in harmony with the environment (July 2022)

|

|

|

Investment in a fund that attracts outstanding nursery school operating companies to urban areas with large numbers of children on waiting lists (March 2022)

|

|

|

Investment in Japan Post Investment Regional Development and Impact Fund I, ILP, which invests in companies that contribute to generating a social impact to achieve regional economic revitalization and the SDGs (April 2022)

|

|

|

Investment in a fund that aims to achieve both social and economic returns by investing in domestic companies that are actively engaged in generating a social impact (May 2022)

|

|

|

Investment in a real estate fund that invests in ESG-friendly residential properties for leasing (July 2022)

|

|

Loans to local governments (using Postal Life Insurance funds)

| Investments | Main Relevant SDGs |

|---|---|

|

Loans to local governments using Postal Life Insurance assets are policy loans carried on by the Organization for Postal Savings, Postal Life Insurance and Post Office Network (the "Organization") after the privatization of the postal service. Japan Post Insurance undertakes credit management duties for these loans under an operations consignment agreement with the Organization. As of March 31, 2022, Japan Post Insurance held loans to approximately 1,800 local governments, totaling approximately 3 trillion yen. Over 90% of the loans were tied to specific uses such as sewage projects, enhancing school facilities, and building public housing. We contribute to promoting infrastructure enhancement and resident welfare through measures such as annual surveys of facilities utilization. |

|