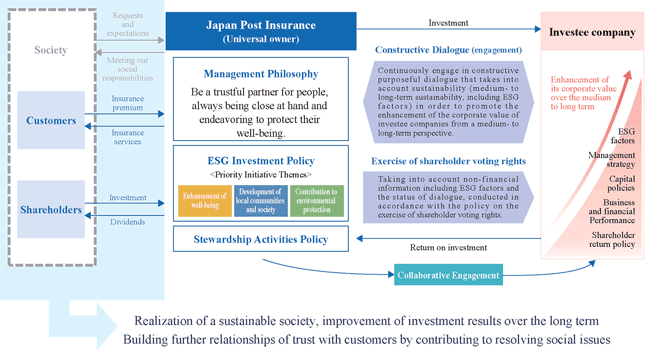

Stewardship Activities

We have been promoting stewardship activities as a universal owner that manages diverse, long-term assets, in order to fulfill our responsibilities and respond appropriately to social demands for compliance with the Japan's Stewardship Code.

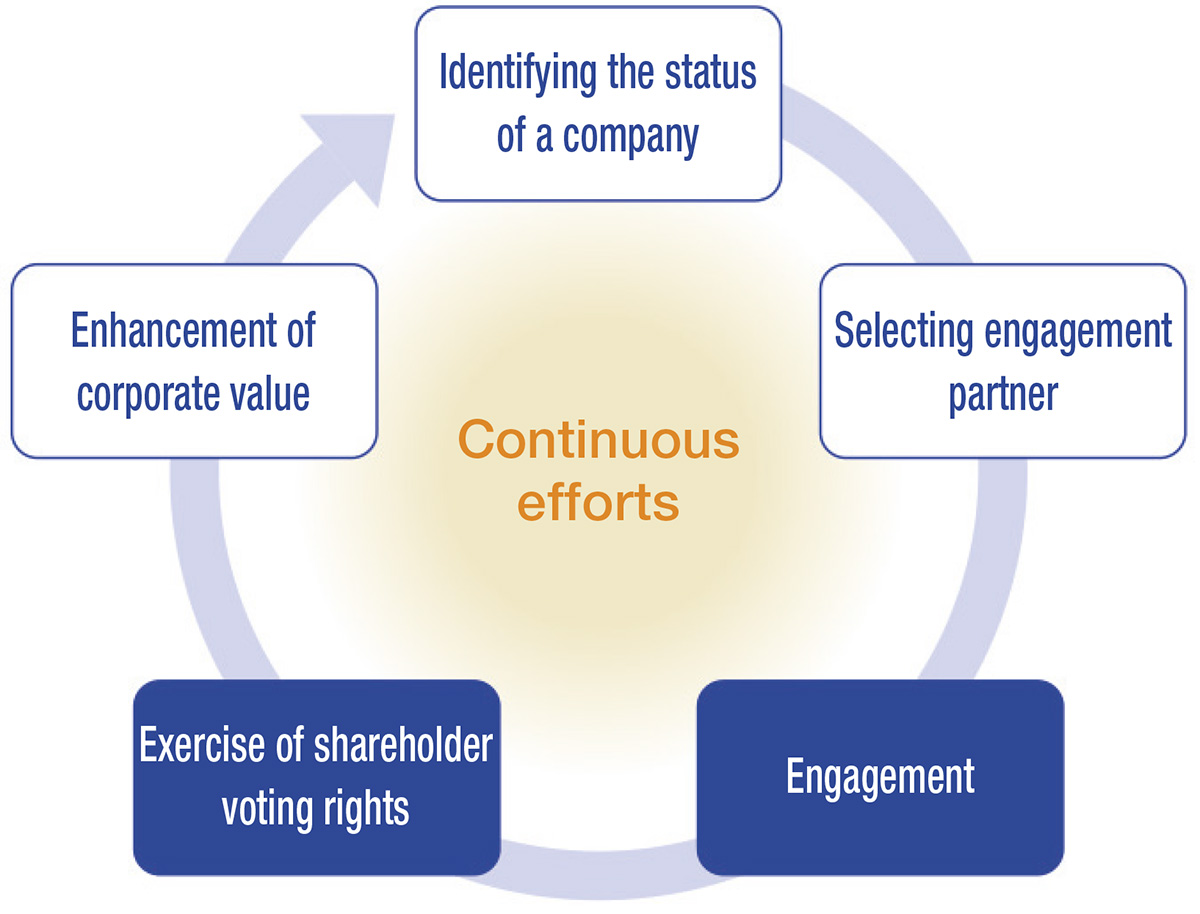

Through constructive dialogue (engagement) with investee companies, we seek to accurately understand their situations, including aspects such as their ESG-related issues, management strategies, and other conditions. By directly engaging with investees, we request the disclosure of investees' financial information and non-financial information, including ESG (Environment, Social and Governance) factors, confirm their efforts to address ESG issues, and share a recognition of these issues.

In exercising our voting rights, we basically follow our shareholder voting policy, but we do not make conventional judgments, rather take into account non-financial information including ESG factors and the status of dialogue, and implement the policy appropriately.

These stewardship activities are deliberated by the Responsible Investment Advisory Sectional Meeting with external experts.

For more detailed information on our ESG investments and stewardship activities, please refer to the Responsible Investment Report.

Stewardship Activities Policy

We have established the Stewardship Activities Policy as our response to each principle set forth in Japan's Stewardship Code and our basic approach to all aspects of stewardship activities. We implement stewardship activities in accordance with this policy.

Until FY2021, our stewardship activities under the Stewardship Activities Policy were limited to domestic equities and domestic corporate bonds, but since FY2022 we have expanded the scope of these activities to include other assets by strengthening engagement measures regarding these assets. We undertake stewardship activities using methods based on the characteristics of each asset.

Flow of stewardship activities

Responsible Investment Report

We publish a Responsible Investment Report to provide more detailed information on our sustainable investment and stewardship activities.

back issue

- Responsible Investment Report (FY2022)

- Stewardship Activities Report(2020.7~2021.6)

- Stewardship Activities Report(2019.7~2020.6)

※ In line with the expanded content of the report, the Stewardship Activity Report was renamed the Responsible Investment Report.

Policy on Exercise of Shareholder Voting Rights

We exercise shareholder voting rights appropriately in accordance with our Policy on Exercise of Shareholder Voting Rights.

In June 2021, taking into account the growing public interest in sustainability and policy trends, we revised our policy to add provisions related to environmental, social and governance (ESG) issues that contribute to the expansion of corporate value, with the aim of encouraging investee companies to make further efforts to improve their sustainability.

Standards for the Exercise of Shareholder Voting Rights

Since May 2022, we have disclosed our Standards for the Exercise of Shareholder Voting Rights, which set forth specific criteria for the exercise of shareholder voting rights on individual proposals.

Results of Exercise of Shareholder Voting Rights (by Agenda)

The results of the exercise of shareholder voting rights and the reasons for approval or disapproval of each agenda item for our domestic stocks (in-house investment) are disclosed.