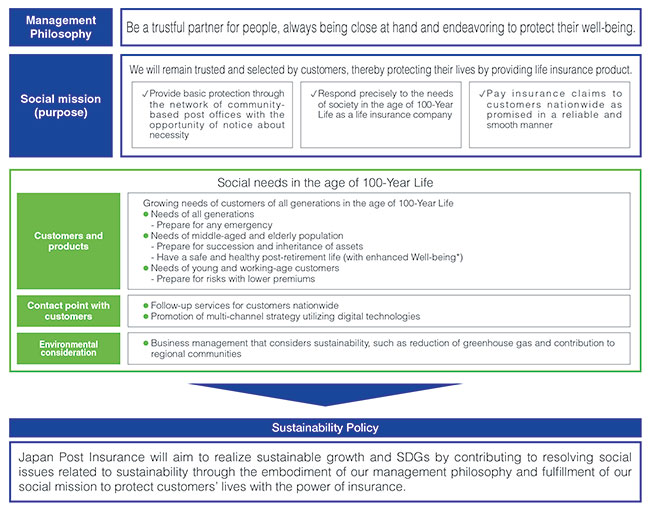

The Concept of Sustainability

Basic Concept

Our predecessor, Postal Life Insurance Service, was launched with the social mission of "protecting the means of fundamental livelihood of the public through simple procedures."

We have been privatized, but our mission to support people's lives through insurance has not changed.

Under our management philosophy "Be a trustful partner for people, always being close at hand and endeavoring to protect their well-being", we have set a "Sustainability Policy" to help resolve social issues and to work to achieve SDGs by fulfilling our social mission (purpose) and meeting social needs in an age of the 100-year life.

We are also working to resolve issues related to sustainability through our business activities.

Sustainability Promotion System

Japan Post Insurance established the Sustainability Promotion Office in the Public Relations Department in April 2021, and the Sustainability Promotion Department in April 2024 to strengthen the promotion framework.

The Sustainability Committee, chaired by the Executive Officer in charge of the Sustainability Promotion Department, discusses sustainability strategies, formulates and reports on the progress of sustainability implementation plans, and reports the status of deliberations and discussions at the Sustainability Committee to the Executive Committee in a timely manner, with important matters being discussed and decided upon at the Executive Committee before being reported to the Board of Directors.

Sustainability Implementation Plan

To fulfill our social mission and address sustainability-related issues, Japan Post Insurance identified five materiality items (important issues), which were reviewed in March 2024 in light of changes in the external environment. In order to promote initiatives in line with materiality, we have formulated a Sustainability Implementation Plan related to each materiality, and we confirm and evaluate the status of implementation. The progress is reported as appropriate to the Sustainability Committee, Executive Committee, and Board of Directors.

Internal Penetration Measures

Conducting Exchange Opinions

We provide opportunities for employees to exchange opinions in small groups on the theme of sustainability, so that each employee can make sustainability their own business and take autonomous action. In the fiscal year ended March 31, 2024, themes included human rights and a base that embodies our management philosophy.

Sustainability Training

To deepen understanding of sustainability and SDGs, we regularly hold sustainability training for executives with external lecturers, and in the fiscal year ended March 31, 2024, we held two sessions on the latest trends in sustainability and purpose-driven leadership.

Kampo Reform Project / SDGs (Sustainability Activities) Category

We have established the SDGs (sustainability activities) category as one of the categories of the Kampo reform project, an internal program that aims to reform our corporate culture by revitalizing inner communication. Each base makes outstanding examples of its initiatives well known across the Company, leading to an increase in new initiatives.

Contributing to Society through Life Insurance Business

Through the life insurance business, we protect customers' lives by paying insurance claims to customers throughout Japan.

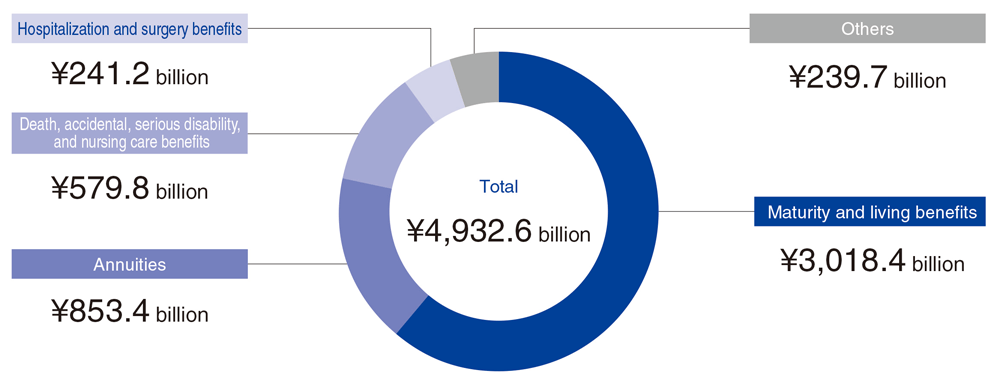

Insurance Claims and Others Paid (FY2024/3)

Our payment amount of insurance claims and others is among the highest in the industry, and we pay insurance claims to a large number of customers to ensure that we fulfill our social mission as a life insurance company.

- The amount of insurance claims and others paid is the sum of insurance claims, annuity payments, and benefits.

- Scope is 42 life insurance companies in Japan (domestic standalone (the Japanese entity in the case of foreign life insurance companies)).

- Source: The Life Insurance Association of Japan, "Life Insurance Statistics Summary (2023)"

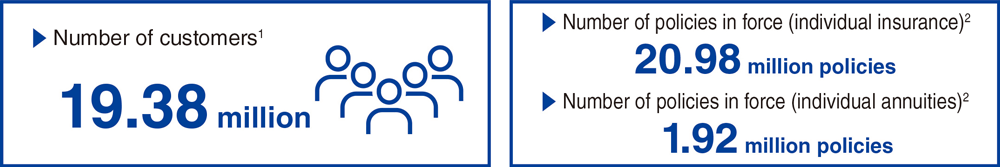

Extremely Large Customer Base

- The number of customers is the sum of policyholders and insured persons (including individual insurance and individual annuities as well as Postal Life Insurance reinsured by us).

- Total population; source: Statistics Bureau of Ministry of Internal Affairs and Communications, "Population Estimates," as of April 1, 2024 (approximate values)

The Post Office Network and Japan Post Insurance Offices across Japan

- Number of elementary schools sourced from Ministry of Education, Culture, Sports, Science and Technology, "School Basic Survey"; as of May 1, 2023

- Number of police boxes and police stations; source: National Police Agency "National Police Facility Names, Locations, etc.," as of April 1, 2023

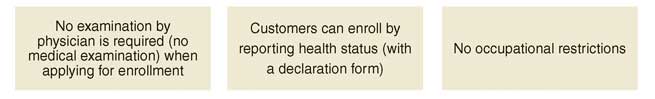

Products with Easy Procedures and Smaller Coverage Amounts

The Company provides simple and easy-to-understand products (with easy procedures and smaller coverage amounts) and services, focusing on endowment insurance and whole life insurance, through the nationwide network of post offices.