Corporate Governance

Basic Concept of Corporate Governance

The Company is working to strengthen corporate governance through our Board of Directors and other bodies. We have established the "Basic Policy Regarding Corporate Governance," which lays out our basic concept of corporate governance, its framework and operations, and the corporate governance structure is developed accordingly.

[Basic Concept of Corporate Governance]

- The Company shall continue to create new convenience for customers and pursue the provision of high-quality services, while generating consistent value by providing life insurance services through the post office network.

- Fully recognizing its fiduciary responsibility to its shareholders, the Company shall give consideration to effectively secure rights and equal treatment of shareholders.

- The Company shall place emphasis on dialogue with all stakeholders including customers and shareholders with an aim to ensure appropriate collaboration and sustainable coexistence. To this end, the Company shall strive to secure management transparency and commit to appropriate disclosure and provision of information.

- The Company shall carry out swift and decisive decision-making and business execution under the effective supervision by the Board of Directors, in order to promptly cope with changes in social and economic environment and meet the expectation of all stakeholders.

- Basic Policy Regarding Corporate Governance

- Corporate Governance Report

- (Reference 1) Articles of Incorporation

- (Reference 2) Directors and Executive Officers

- (Reference 3) Board of Directors Regulations

- (Reference 4) Management Philosophy

- (Reference 5) Medium-Term Management Plan

- (Reference 6) Fundamental Policy for Establishment of Internal Control Systems

- (Reference 7) Appointment and Dismissal Criteria for Executive Officers

- (Reference 8) Reasons for Appointment of Executive Officers

- (Reference 9) Nomination Criteria for Candidates for Directors

- (Reference 10) Reasons for Nominating the Candidates for Directors

- (Reference 11) Designation Criteria for Independent Officers

- (Reference 12) Compensation Policies for Directors and Executive Officers by Individual

Matters concerning controlling shareholders, etc.

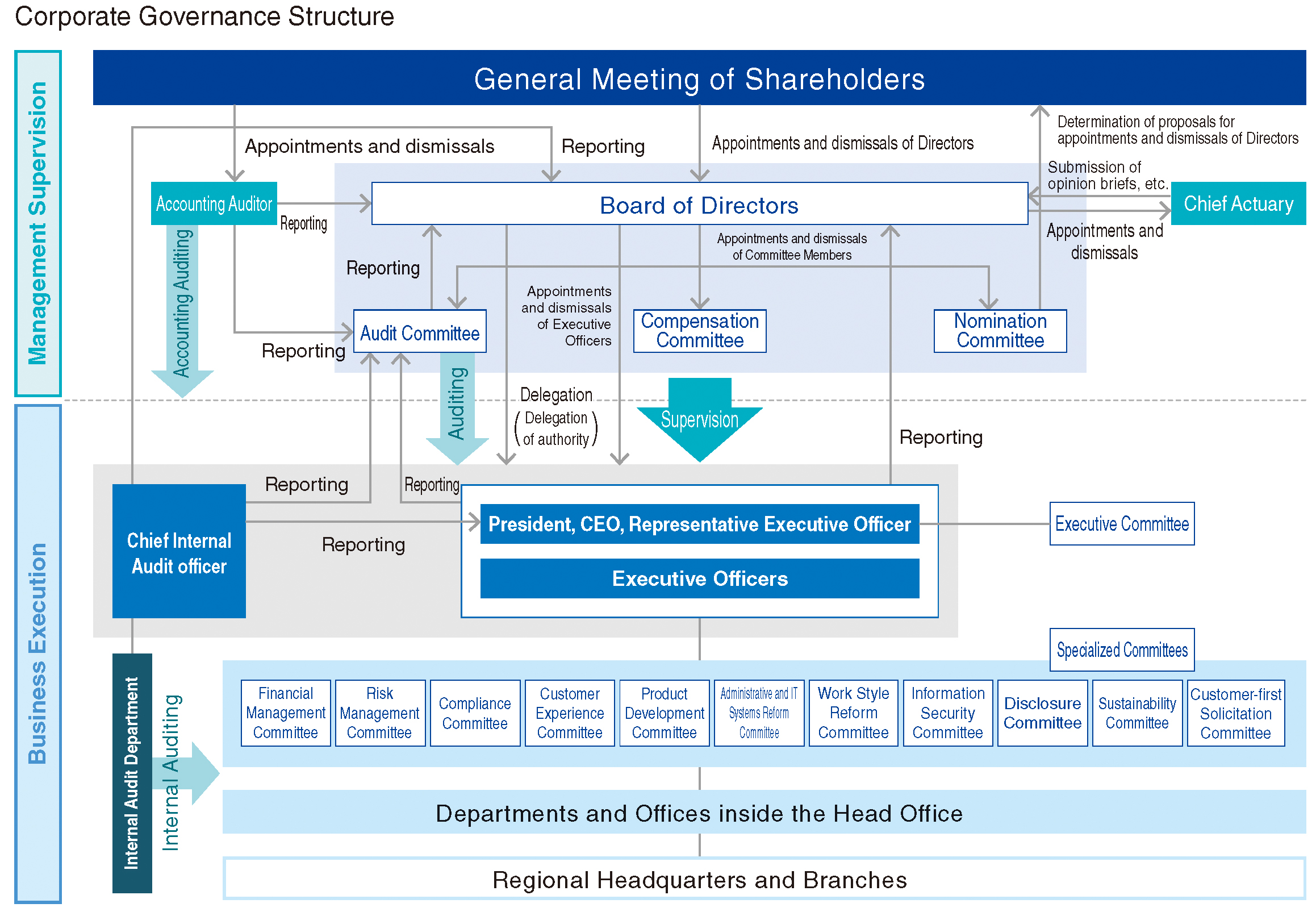

Corporate Governance Systems

Japan Post Insurance considers the establishment of strong internal control systems to be extremely important to increasing our corporate value and to our goal of becoming the "No. 1 Japanese insurance company selected by customers." We have established systems for the execution of our business based on the principle of self-responsibility and have continued our efforts to enhance our organization and systems.

Corporate Governance Overview

To speed up decision-making and enhance the transparency of management, we have adopted a company with a three-committee structure, under which the Board of Directors' role of management supervision is separated from the Executive Officers' role of business execution, thereby clarifying responsibilities with respect to corporate management.

Important management decisions related to business execution are first discussed by the Executive Committee and then made by the President, CEO, Representative Executive Officer.

The Executive Committee is comprised of the President, CEO, Representative Executive Officer and the Executive Officers in charge of the respective business operations. In addition, we set up the following 10 specialized committees to serve as advisory bodies to the Executive Committee. Among the items subject to approval of each Executive Officer, cross-divisional issues are discussed by the respective specialized committees.

Furthermore, in order to promptly and reliably implement measures under the leadership of

management and improve solicitation quality, we have established a Customer-first Solicitation Committee and hold discussions.

Board of Directors (Management Supervision)

The Board of Directors of the Company determines matters such as the basic management policy of the Company, segregation of duties of Executive Officers and the fundamental policy for establishment of internal control systems and has the authority of supervising the execution of duties by Executive Officers. Meanwhile, the Board of Directors promotes the development of a framework that enables supervision of management from the external and broader perspective by appointing lawyers and corporate managers as Outside Directors.

The three committees, the Nomination Committee, the Audit Committee and the Compensation Committee, have been established to fully utilize external views on the management of the Company and ensure the transparency and fairness of decision-making of the management. The specific roles of these committees are as follows:

Nomination Committee

The committee determines proposals for general meetings of shareholders concerning the election and dismissal of Directors.

Committee Chair: HARADA Kazuyuki(Outside Director)

Members: TANIGAKI Kunio, MASUDA Hiroya, SUZUKI Masako (Outside Director),YAMANA Shoei (Outside Director)

(Membership composition as of June 17,2024)

Audit Committee

The committee audits the execution of duties by Directors and Executive Officers, prepares audit reports, determines the content of proposals regarding the election and dismissal of the accounting auditor to be submitted to general meetings of shareholders and approves the compensation for the accounting auditor.

Committee Chair: SUZUKI Masako(Outside Director)

Members: NARA Tomoaki, TONOSU Kaori (Outside Director),TOMII Satoshi (Outside Director), OMACHI Reiko (Outside Director)

(Membership composition as of June 17,2024)

Compensation Committee

The committee formulates compensation policies for Directors and Executive Officers and determines detailed compensation for each individual.

Committee Chair: TOMII Satoshi(Outside Director)

Members: MASUDA Hiroya, HARADA Kazuyuki(Outside Director),SINGU Yuki (Outside Director)

(Membership composition as of June 17,2024)

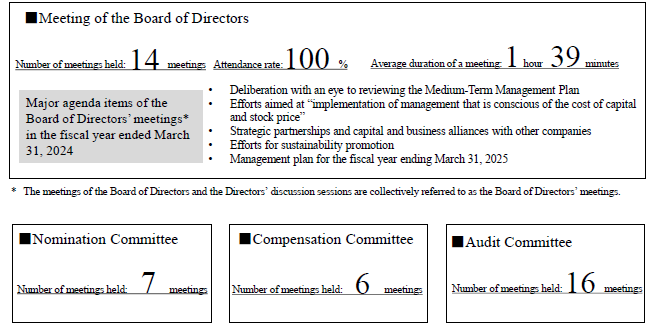

Status of Operations of the Board of Directors and Committees in FY2023

In order to discuss management issues in advance, Japan Post Insurance has established the "deliberation" process that will leverage the expertise of Outside Directors from the resolution drafting stage as well as the resolution and report. Moreover, through the Directors' discussion sessions held as a venue for reporting in advance on the status of consideration by the executive side, meetings of Outside Directors and other meetings, Japan Post Insurance has established opportunities to enhance the exchange of opinions among Directors.

We are also working to ensure effective and smooth operations of the Board of Directors such as by providing Directors with accurate information as needed, providing thorough explanations on the details of proposals in advance, and ensuring that there is time for prior discussion and question-and-answer sessions at the Board of Directors.

Nomination Criteria for Candidates for Directors / Designation Criteria for Independent Officers / Skill Matrix for Directors

The Nomination Committee has formulated the "Nomination Criteria for Candidates for Directors" that stipulates our philosophy regarding balance of knowledge, experience and skills, as well as the diversity and scale of the Board of Directors as a whole, along with qualifications the Company requires of Directors. Based on these standards, the Nomination Committee selects candidates for Directors. The Nomination Committee also formulates the "Designation Criteria for Independent Officers" stipulating the Company's requirements for Outside Directors with no concerns of risk of conflict of interest with shareholders, and designates Independent Officers from among the Outside Directors.

In addition, we have formulated the "skill matrix for directors."

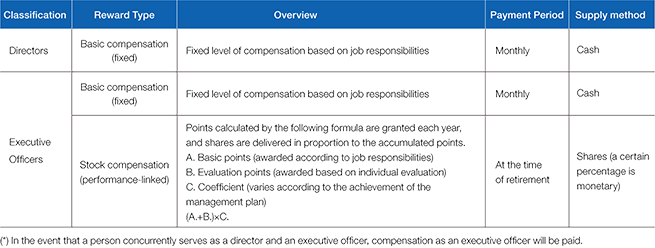

Executive Compensation

With respect to compensation for our Directors and Executive Officers, the Compensation Committee has established the "Compensation Policies for Directors and Executive Officers by Individual" and determines compensation based on these policies.

Basic (fixed) Compensation

Directors are paid a certain level of fixed monetary compensation in accordance with their positions based on the primary role of supervision of management, while executive officers are paid a certain level of fixed monetary compensation in accordance with their responsibilities, taking into account the size of their responsibilities and the current state of the Company.

Specifically, the Compensation Committee has established Compensation Standards for Executives. The monthly compensation for directors varies depending on whether they are full-time, part-time, or committee members. The monthly compensation for executive officers varies depending on their position.

However, should the compensation commensurate with the position of an Executive Officer who is in charge of a field that requires special business knowledge and skills fall significantly below the general level of compensation of an officer who is in charge of a similar field at another company, such Executive Officer shall receive a basic compensation based on the level of compensation of other companies, instead of compensation commensurate with his or her duties in the Company.

Summary of performance-linked monetary compensation

Performance-linked monetary compensation (hereinafter, the "bonus") is granted in a form of monetary compensation that is linked to short-term performance so that it functions as an incentive for achieving solid annual performance targets.

The amount of bonus is calculated by adding the amount obtained by multiplying the standard amount for each position related to individual performance by the payout rate based on individual performance evaluation, and the amount obtained by multiplying the standard amount for each position related to the Company's performance by the variable payout rate based on the degree of achievement of management plans and other factors.

Evaluation for each Executive Officer is determined by individually evaluating the results, statuses, and other factors of operations of which such Executive Officers are in charge.

Regarding indicators related to the Company's performance, in order to enable the Company to comprehensively evaluate the degree of achievement of management, the indicators are selected from multiple different categories.

The indicators are "Adjusted profit," "Numbers of policies in force" and "EV growth (RoEV)," all of which are financial indicators, and "the progress of the Medium-Term Management Plan" and "the occurrence of misconducts and incidents and the status of operation of compliance systems," which are non-financial indicators, since they are suitable for the Company's business structure and business operations.

The Company has in place a system requiring the return of all or part of bonuses paid to an eligible Executive Officer (clawback) in the event of any material misconducts or violations, etc. committed by such Executive Officer.

Summary of stock compensation

With regard to the Company's Executive Officer stock compensation to provide an incentive that is linked to the Company's share value, the stock compensation system comprises performance-linked stock compensation that reflects medium- to long-term performance and non-performance-linked stock compensation.

The stock compensation system adopts a Board Benefit Trust structure.

Executive Officers will be granted points that form the basis of calculating the amount equivalent in value to the number of shares of the Company given, or a specified proportion thereof, converted to money (hereinafter, "the Company's shares, etc."), in accordance with items (1) and (2) below.

(1) Performance-linked stock compensation

After the end of the last fiscal year of the Medium-Term Management Plan, Executive Officers will be awarded points based on basic points for their corresponding responsibilities, multiplied by a variable payout rate arrived at based on the degree to which they have met the performance targets in the Medium-Term Management Plan.

The Company adopts medium- to long-term targets and indicators defined in management plans as performance targets that serve as a basis for determining the payout rate, so that they function as sound incentives for enhancing the medium- to long-term corporate value and the sustainable growth of the Company. Such indicators consist of "Adjusted ROE," which is one of the key financial indicators in the current Medium-Term Management Plan, and "ESG indicators (the implementation status of GHG emissions reduction initiatives, the ratio of female managers at the head offices, and the progress of improvements in evaluations by ESG assessors)," which are non-financial indicators.

The Company has in place a system enabling the reduction or forfeit of points that serve as a basis for calculating the number of shares to be granted to an eligible Executive Officer (malus) in the event of any material misconducts or violations, etc. committed by such Executive Officer.

(2) Non-performance-linked stock compensation

After the end of each fiscal year, Executive Officers will be awarded basic points based on their corresponding responsibilities.

Eligible Executive Officers who retire from the Company may, after retirement, and where they fulfil the requirements for grant set forth in the Board Benefit Trust regulations, receive from the Trust the Company's shares, etc. corresponding to the cumulative number of points awarded based on items (1) and (2) above.