Main Text starts here.

Stock Information

Shareholder Return

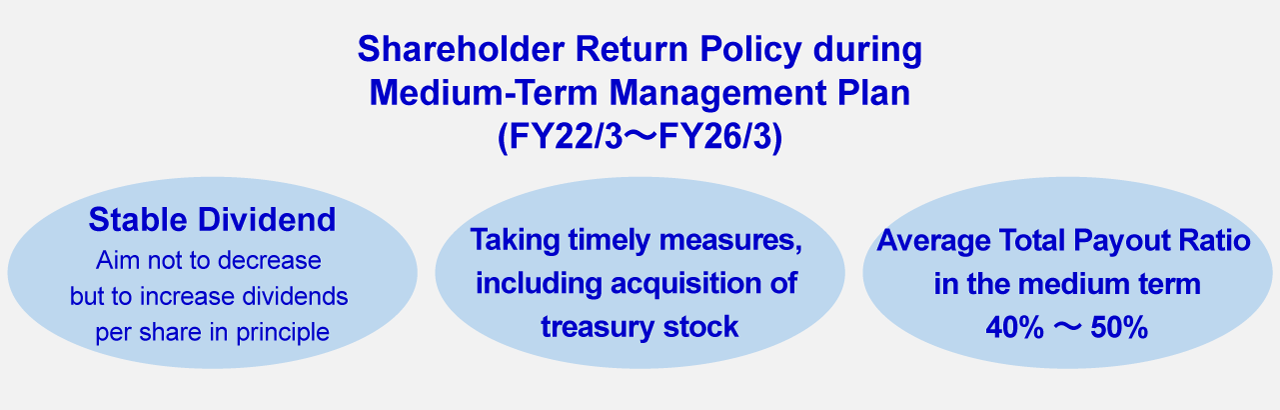

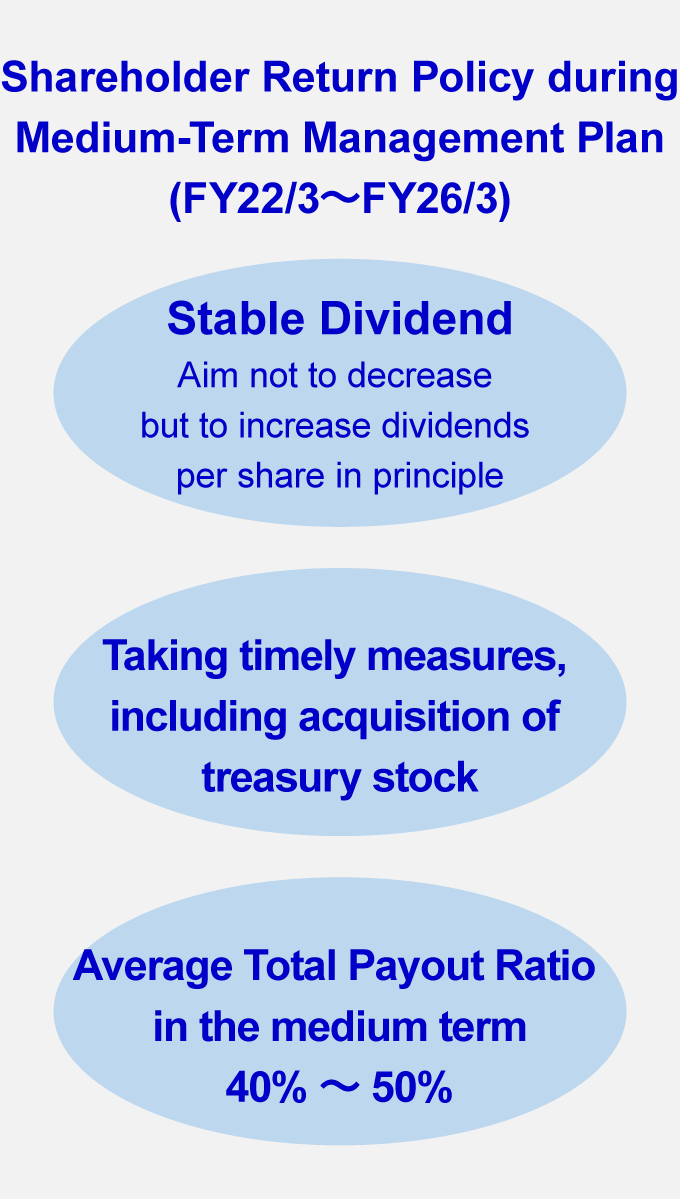

Shareholder Return Policy

JAPAN POST INSURANCE Co., Ltd. (the “Company”) recognizes that the

distribution of profit to shareholders is an important policy of management, and

distributes profits to shareholders stably, while securing management soundness.

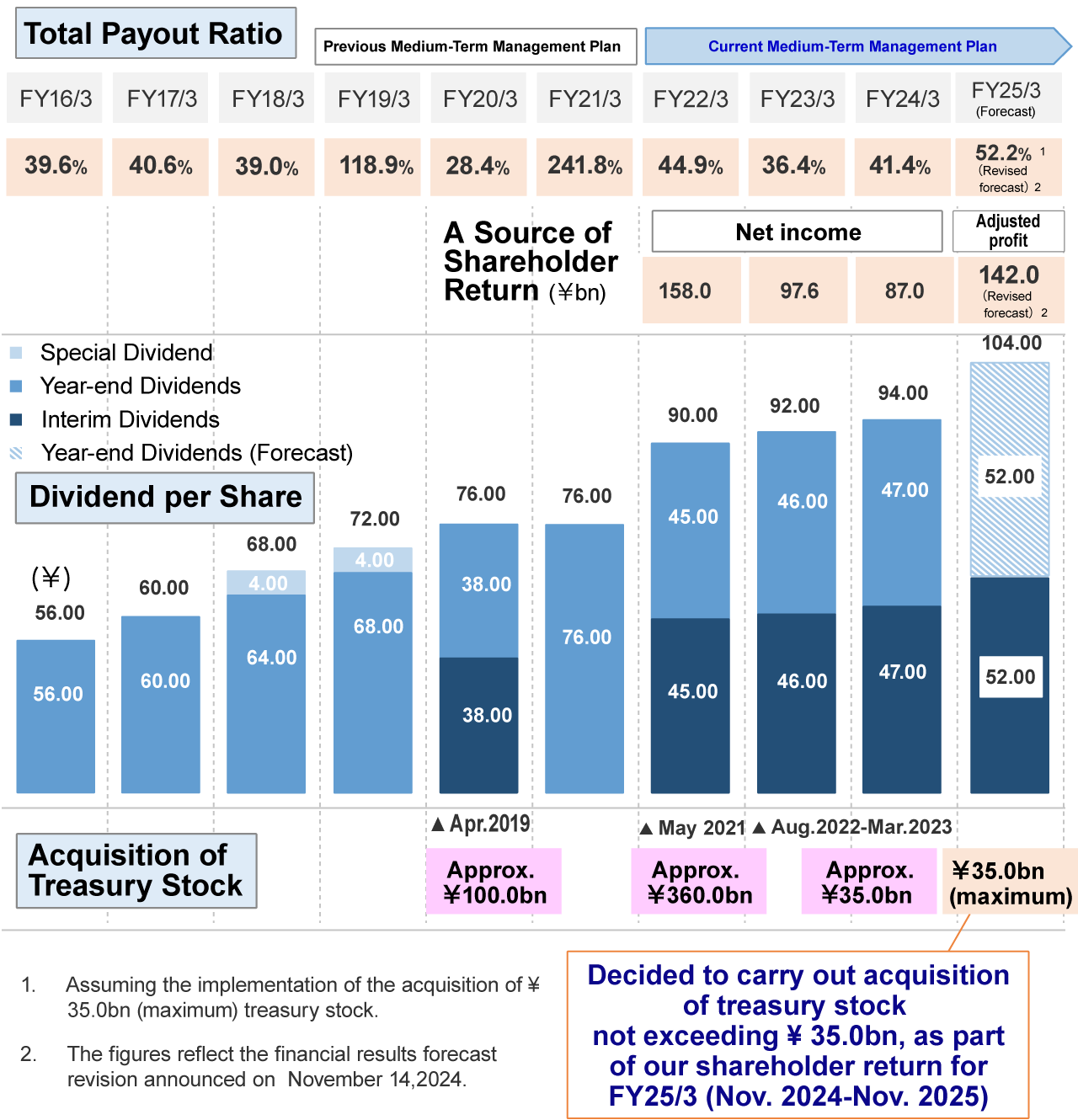

Specifically, with regard to shareholder dividends, the Company in principle aims not to decrease but to increase dividend

per share for the period of the Medium-term Management Plan up to FY2025, while

considering earning prospects and financial soundness.

Furthermore, with the primary aim of returning profits to shareholders flexibly, the Company will strive to achieve an average total payout ratio from 40% to 50% in the medium term by engaging in the agile acquisition of treasury stock and other means.

Upon reviewing the Medium-term Management Plan in May 2024, the Company has established a new financial target “adjusted profit,” which is partially adjusted for the effect, etc. unique to life insurance companies whose net income is reduced in the short term as new policies increase. From the fiscal year ending March 31, 2025, the Company aims to provide stable returns to shareholders by treating “adjusted profit” as a source of shareholder return.

The Company secures internal reserves to fund stable business growth to enable it to respond to future changes in the business environment.

Interim dividend

The Company stipulates in its Articles of Incorporation that it is able to pay interim dividends with a record date of September 30 of each year. For the purpose of enhancing the opportunities to distribute profits to shareholders, the Company plans to provide cash dividends twice a year as the interim dividends and the year-end dividends.

Status of Share Repurchase

As of February 14 , 2025

| Period of Share Repurchase | Method of Repurchase | Total Number of Shares Repurchased | Total Amount of Repurchase(yen) |

|---|---|---|---|

| April 8, 2019 | Purchases through the Off-auction Own Share Repurchase Trading system (ToSTNeT-3) of the Tokyo Stock Exchange | 37,411,100 | 99,999,870,300 |

| May 17, 2021 | Purchases through the Off-auction Own Share Repurchase Trading system (ToSTNeT-3) of the Tokyo Stock Exchange | 162,906,300 | 358,882,578,900 |

| August 12, 2022 | Purchases through the Off-auction Own Share Repurchase Trading system (ToSTNeT-3) of the Tokyo Stock Exchange | 8,462,200 | 17,499,829,600 |

| From August 15, 2022 to March 13, 2023 | Purchases through trading on the auction market of the Tokyo Stock Exchange | 8,039,200 | 17,500,137,100 |

| From November 15, 2024 to November 14, 2025 (*) | - | 30,000,000 (maximum) |

35,000,000,000 (maximum) |

* What is indicated here is the resolutions of the meeting of the Board of Directors held on November 14, 2024.

Relate starts here.