Compliance and Anti-Corruption

We assure the soundness and appropriateness of our business operations and promote compliance and anti-corruption by ensuring that all executives and employees comply with laws and regulations (laws, regulations, internal rules, social norms, and corporate ethics) in every aspect of our corporate activities. To this end, we have established our compliance framework by formulating compliance rules that set out the basics for the promotion of compliance within the Company. These rules incorporate the "Fundamental Policy for Establishment of Internal Control Systems" developed by the Company's Board of Directors.

We recognize that violations of laws and regulations, including corruption, cause our customers and other stakeholders to lose trust in the Company and significantly damage our corporate value. We regard the prevention of such violations as our one of the most important management issues.

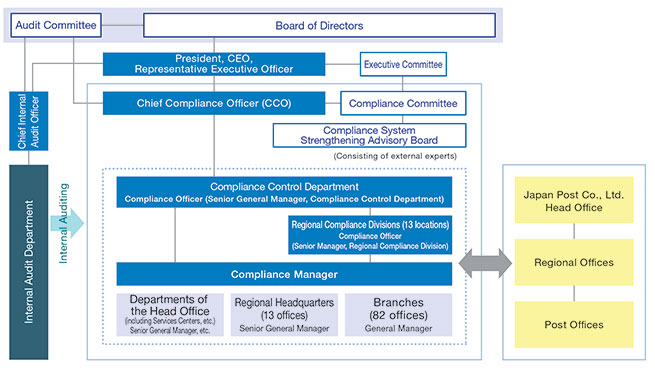

Compliance Promotion System

To promote compliance within the Company, we have established the Compliance Committee, headed by the Chief Compliance Officer (CCO). The Compliance Committee deliberates on management policies concerning compliance, specific compliance operations and response to various compliance issues. The committee also works to achieve thorough compliance and prevent compliance violations by monitoring and analyzing the Company's compliance promotion efforts. In addition, the CCO reports important matters discussed at the Committee to the Executive Committee, the Audit Committee, and the Board of Directors. The Compliance Committee has also established Compliance System Strengthening Advisory Board, which consists of external experts and other members and acts as an expert panel to the Compliance Committee in order to help strengthen the compliance system.

We have assigned the Senior General Manager of the Compliance Control Department, the Senior Manager of the Compliance Investigation Office, and the Senior Manager of the Information Security Control Office to act as compliance officers in charge of compliance. We have also assigned the senior managers of the Regional Compliance Divisions at our 13 locations throughout Japan to act as compliance officers. In addition, we have assigned compliance managers responsible for promoting compliance in their departments at the head office (including services centers, etc.), regional headquarters, branches and Retail service division. In this way, we have established a company-wide system to promote compliance.

The Internal Audit Department conducts internal audits to check the status and operation of the compliance system and to strengthen the Company's compliance promotion system.

Dealing with Compliance Violations

If a compliance violation or suspected compliance violation is discovered, we will investigate and clarify the facts and causes of the violation and based on those results, we will formulate and implement measures to prevent future recurrence.

In addition, disciplinary action, including punitive dismissal, may be taken in accordance with disciplinary rules, etc.

Implementing Compliance Education

Each fiscal year, as a concrete practical plan to promote compliance, we formulate a Compliance Program and develop a training program. Based on this training program, we conduct training for the compliance managers assigned to each department in order to explain and offer instruction regarding the role of compliance managers and points to keep in mind in terms of compliance in practice. We also conduct e-learning for all executives and employees to impart and disseminate compliance knowledge.

We have also prepared the Compliance Manual, which is a concrete guide for achieving compliance, and the Compliance Handbook, which explains the main points of the Manual. In addition to providing explanations of laws and regulations that executives and employees must comply with and how to deal with illegal activities when they are discovered, the handbook also contains information on the prohibition of corrupt practices such as bribery, embezzlement, transactions with conflicting interests, and insider trading.

Furthermore, by distributing compliance cards to all executives and employees, we work to ensure that all executives and employees carry out their duties with compliance as their top priority.

Incorporation into the Personnel Evaluation System

We evaluate each employee's efforts by setting targets related to "compliance observance" among the personnel evaluation items for managers and general employees.

Anti-Corruption Initiatives

We support the aims of the United Nations Global Compact, in which the Japan Post Group has participated since 2008. We operate based on 10 principles related to human rights, labor, the environment, and anti-corruption.

In addition, the Code of Conduct, which are based on our management philosophy, asserts "We leave no stone unturned in ensuring compliance based on a strong ethical sense of the company as a responsible member of society".

Prevention of Bribery

We intend to thoroughly enforce the prohibition of bribery of public officials, etc., by executives and employees, and regulations concerning political funds which we have clearly specified in our Compliance Manual. In addition, in the Compliance Handbook, executives and employees are informed of specific cases in which it is necessary to strictly refrain from providing entertainment or cash gifts that exceed the scope of restrictions imposed by laws and regulations, or from accepting bribes or inappropriate payoffs, or from demanding bribes. In this way, we are working to prevent bribery and corruption.

Measures related to Anti-Money Laundering, Combating the Financing of Terrorism, and Countering Proliferation Financing

We have formulated the Policy on Anti-Money Laundering, Combating the Financing of Terrorism, and Countering Proliferation Financing in accordance with the FSA's Guidelines for Anti-Money Laundering and Combating the Financing of Terrorism. Based on this policy, we will promote initiatives to appropriately mitigate risks of money laundering, the financing of terrorism and proliferation financing (hereinafter referred to as "Money Laundering").

From the perspective of preventing the abuse of our products and services for Money Laundering, we identify and evaluate risks based on the characteristics of our businesses and the status of our representative offices, as well as laws and regulations, and take appropriate measures commensurate with these risks in order to effectively mitigate them.

In addition, the management is taking the initiative in promoting measures to prevent Money Laundering, and we have appointed the CCO as the person in charge of anti-Money Laundering, etc. measures. We clearly define the roles and responsibilities of executives and employees involved in anti-Money Laundering, etc. measures.

Elimination of Antisocial Forces

To eliminate and avoid any relationships with antisocial forces, our "Fundamental Policy for Establishment of Internal Control Systems" requires the ending of all relationships with antisocial forces that pose a threat to the order of society and sound corporate activities by routinely collaborating with the police and other outside experts, and firmly rejecting the unjustified demands of antisocial forces. In addition, based on this policy, we have created the "Basic Policy on Handling of Antisocial Forces" as well as "Rules for Handling of Antisocial Forces," which define our framework for avoiding all relationships with antisocial forces and the basics for organizational actions.

As specific measures, we incorporated a clause against organized crime into our policy agreements in April 2012. Other measures include checking all policies in force for any link with antisocial forces and incorporating a clause against organized crime into other contracts. We also encourage the people in charge of countering unjustified demands to participate in the corresponding training seminar; work to reinforce our ties with the police, lawyers and other external organizations; and provide guidance to employees through training programs.

Management of Conflicts of Interest

To prevent our customers' interests from being unduly harmed in conjunction with conflicts of interest transactions between our customers and Japan Post Insurance, we have released the "Conflicts of Interest Management Regulations" in light of the Insurance Business Act and Financial Instruments and Exchange Act, and other laws and regulations. As a person who manages and controls conflicts of interest, the Chief Compliance Officer (CCO) is assigned as the Chief Conflict of Interest Management Officer. The Senior General Manager of the Compliance Control Department has been assigned as the person who assists the Chief Conflict of Interest Management Officer and oversees managing conflicts of interest. In this way, we have established a system to ensure compliance with laws, regulations, and our rules, while appropriately managing and executing our business. Japan Post Group has released the "Japan Post Group Conflicts of Interest Management Policy." This Policy governs the management of conflicts of interest transactions by our Group as a whole in order to prevent our customers' interests from being unduly harmed.

In accordance with the Companies Act, we have also announced in our Basic Policy Regarding Corporate Governance that the Board of Directors will exercise appropriate supervision over transactions conducted by directors and executive officers for their own benefit or for the benefit of third parties, to ensure that such transactions are not conducted at the expense of our interests. In addition, in accordance with the "Conflicts of Interest Transactions Management Regulations", we comply with laws and regulations and properly manage and execute our business. Specifically, the necessity of the relevant conflict-of-interest transaction and other material facts are submitted to the Board of Directors for approval. In addition, to ensure that such approval is obtained, the Corporate Planning Department has been designated as the department in charge of the overall management of transactions that involve conflicts of interest. We ensure an appropriate management system by confirming the schedule and results of transactions, as well as the results of self-inspection before and after the performance of transactions by the department conducting the transactions.

Requests for Business Partners

To achieve anti-corruption throughout the entire value chain of our business, when making decisions on investments in new business partners (subsidiaries, affiliates, etc.), we stringently check their management systems regarding bribery, money laundering, and relationships with antisocial forces as part of our due diligence procedures. When procuring goods and services necessary for business, we also request suppliers to comply with the Japan Post Group CSR Procurement Guidelines to promote fair and equitable transactions, consider the environment, prevent corruption, and strengthen information security.

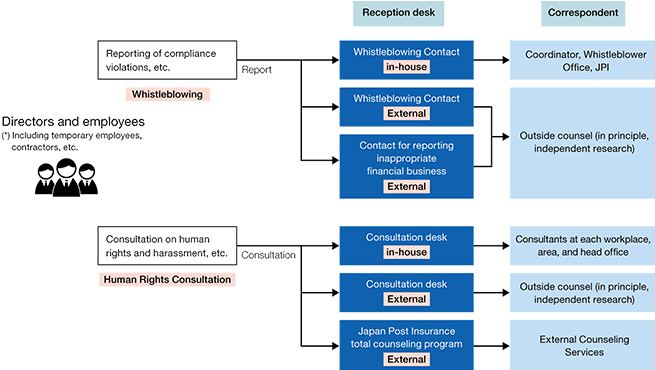

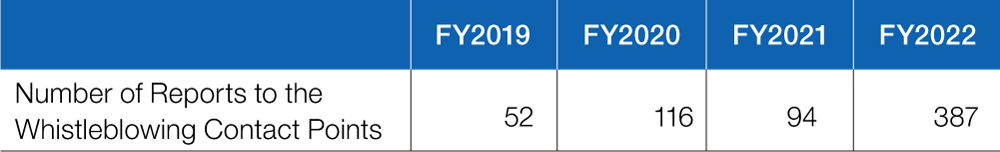

Whistleblowing and Consultation System

The Company has established whistleblowing contact points at the Compliance Control Department of the Head Office and outside Attorney's Office for employees (including temporary employees). The whistleblowing contact points aim to achieve early detection and the resolution of acts of violations or possible violations of compliance including bribery and corruption. Based on the improper solicitation related to our products uncovered in 2019, the Japan Post Group has newly established an external whistleblowing contact point exclusively for financial product sales issues since March 2020.

The Company will, if deemed necessary, conduct an appropriate investigation of the internal report received while ensuring the confidentiality of the reported information. If the investigation reveals a violation of compliance regulations, the Company imposes the necessary disciplinary action on the offender.

In operating the whistleblowing system, we take the utmost care to ensure that the whistleblower is not identified when investigating the content of the report. We will ensure the protection of whistleblowers by stipulating in our regulations that strict measures, including disciplinary action, will be taken against any actions that identify the whistleblower or disadvantage the whistleblower. By thoroughly protecting whistleblowers in this way, the company has established an environment that facilitates whistleblowing.

Since September 2021, the Japan Post Group has introduced a dedicated portal site, the "One-Stop Consultation and Reporting Platform" which will guide whistleblowers to the most appropriate contact point for consultation and reporting of harassment and other violations of compliance by simply selecting the content of the consultation or reporting and the response desired by the company. In addition to the introduction of the "One-Stop Consultation and Reporting Platform", we have also adopted a system in which the acceptance of whistleblowing and the investigation of reported events are conducted by "External Specialist Team" consisting of solely outside attorneys and their assistants.

In order to eradicate human rights issues and harassment in the workplace, we have established a comprehensive counseling program ("Total Counseling Program") where employees and their families can freely consult with outside experts by phone, in person, and via the Internet.

Outline of whistleblowing and human rights consultation (flow image)

Whistleblowing System for external parties

We also accept reports from our contractors (suppliers) under the above-mentioned whistleblowing system. As with reports from employees, we ensure anonymity to our contractors upon request. In addition, we also take appropriate measures to handle reports from outside the company made to Japan Post Insurance Call Center and other organizations. We investigate these reports to determine whether a compliance violation has occurred. If a compliance violation is confirmed, we take the necessary disciplinary action against the offender.