Main Text starts here.

Financial Information

Latest Financial Results and Forecast

Latest Financial Results

Q3 FY2024 Consolidated Financial Results announced on February 14, 2025

Despite the impact of the increased burden of regular policy reserves related to an increase in new policies, net income increased by 29.6% year on year to \ 84.4 billion, as a result of an increase in investment income caused by an improvement in the market environment, etc.

Adjusted profit that takes into account the impact of the increased burden of regular policy reserves in the first year of new policies and amortization of goodwill significantly increased by 62.3% year on year to ¥ 106.3 billion.

-

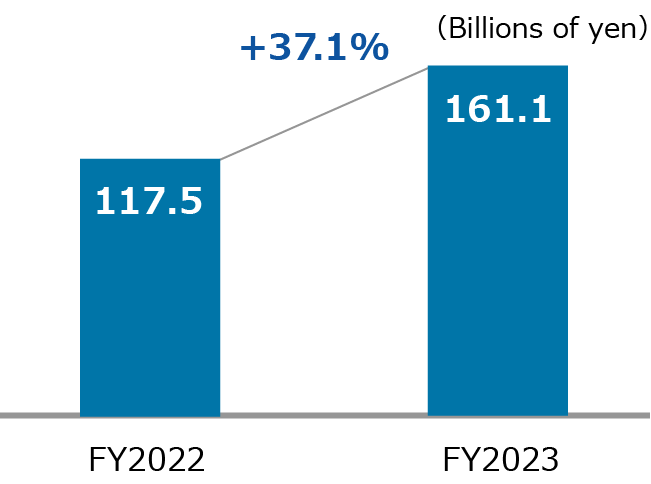

Net income

-

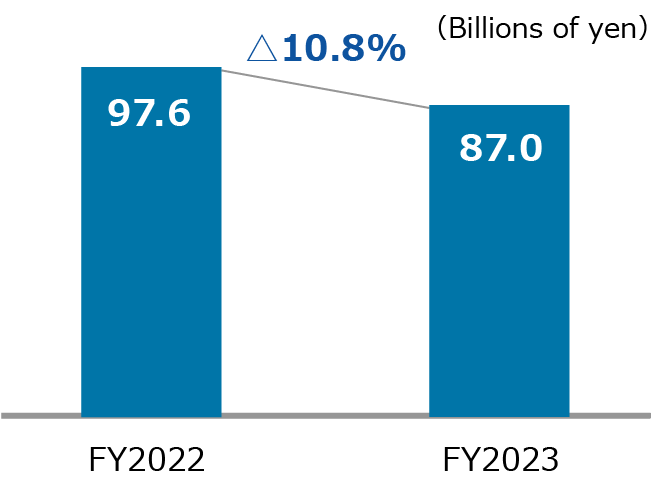

Adjusted profit

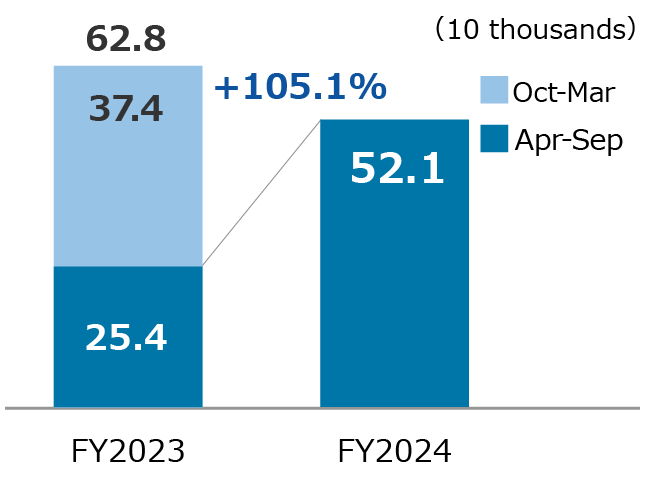

The number of new policies for individual insurance continued to increase significantly by 81.4% year on year to 680 thousand.

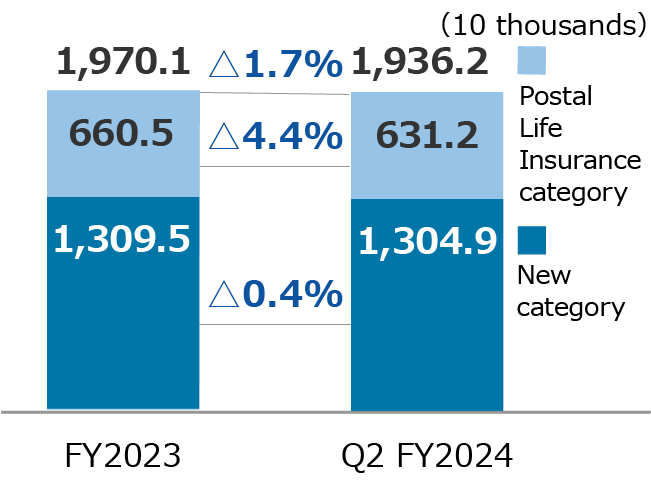

While the number of policies in force decreased by 3.0% to 19,114 thousand from the end of the previous fiscal year, the number of new-category policies in force decreased by only 1.2% from the end of the previous fiscal year due to an increase in the number of new policies, and we continue to aim for a swift turnaround and recovery in the new category.

-

Number of New Policies

(Individual Insurance)

-

Number of Policies in Force

(Individual Insurance)

- “New category” shows individual insurance policies underwritten by Japan Post Insurance. “Postal Life Insurance category” shows postal life insurance policies reinsured by Japan Post Insurance from Organization for Postal Savings, Postal Life Insurance and Post Office Network.

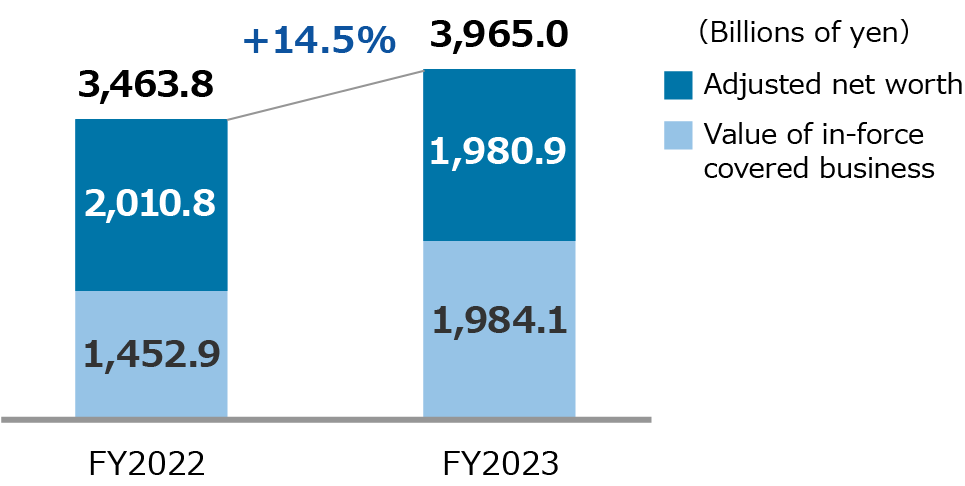

EV*1 for Q3 FY2024 increased by 2.5% from the end of the previous fiscal year to ¥ 4,066.4 billion mainly due to an increase in value of new business*2, etc.

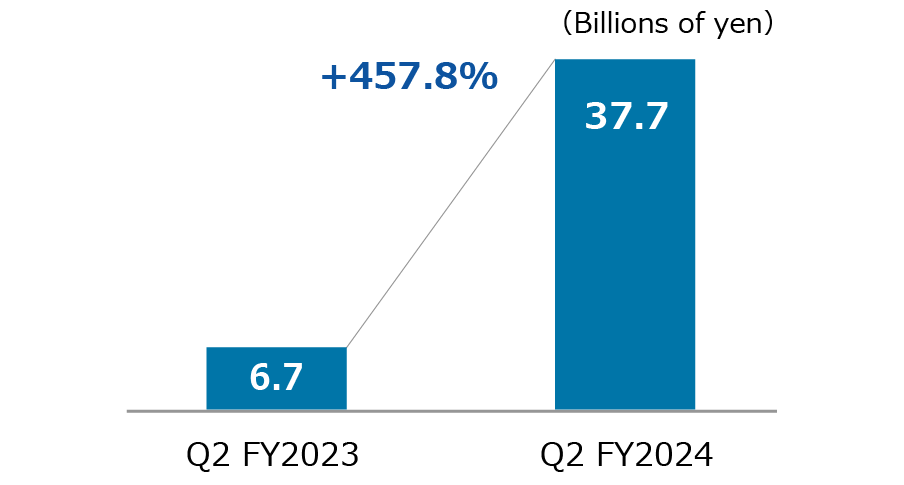

The value of new business increased significantly by 337.7% year on year to \ 49.3 billion due to higher interest rates and an increase of the number of new policies.

-

EV

-

Value of new business

- EV is an abbreviation for Embedded Value, and one of the corporate value indicators for life insurance companies.

The profit-loss structure in the life insurance business involves a loss at the time of sale and profit over a policy’s duration. A loss occurs temporarily at the time of sale, caused by a considerable amount of expenses generally incurred with the sale of a policy. Future profit is generated as the policy’s long duration serves to provide revenues over a long period of time, covering these initial expenses.

Under the current statutory accounting practices in Japan, gains and losses are recognized as they occur in each fiscal year. EV, on the other hand, is used to represent the present value of gains and losses that cover the entire duration. EV is the sum of the adjusted net worth, which reflects gains/losses from business activities in the past, and the value of in-force covered business, which is the present value of the expected future profits from the in-force covered business. - Value of new business is the value as at the time of sale of the new business issued in the relevant year.

- With regard to methodology and assumptions for the calculation of EV (Embedded Value) and value of new business, please refer to disclosure document for EV or Conference Call Material for each period.

For details, please check the latest ‘Conference Call Material’ and ’Performance and Financial Data’

Financial Results Forecast

FY2024 Consolidated Financial Results Forecast revised on Nov 14, 2024

We have made upward revisions to the forecasts for full-year financial results for the fiscal year ending March 31, 2025, mainly due to an expected increase in investment income caused by an improvement in the market environment. The revised forecast for net income is ¥ 120.0 billion, up ¥ 41.0 billion from the initial forecast. Adjusted profit that takes into account the impact of the increased burden of regular policy reserves in the first year of new policies is expected to be around ¥ 142.0 billion, up ¥ 51.0 billion from the initial forecast.

(Billions of yen)

| FY2024 (Previous forecasts) |

FY2024 (Revised forecasts) |

Q3 FY2024 (Updated on Feb 14, 2025) |

Achievement | |||

|---|---|---|---|---|---|---|

| Ordinary income | 5,960.0 | 6,130.0 | 4,334.6 | 70.7% | ||

| Ordinary profit | 200.0 | 220.0 | 222.7 | 101.3% | ||

| Net income | 79.0 | 120.0 | 84.4 | 70.4% | ||

| Adjusted profit | Approx. 91.0 | Approx 142.0 | 106.3 | 74.9% | ||

[Definition of adjusted profit (to be introduced from FY2024)]

In order to partially adjust for the effect unique to life insurance companies whose net income is reduced in the short term as new policies increase, from FY2024 we introduce “adjusted profit” taking into account the adjustment for the increased burden of regular policy reserves after tax in the first year of new policies.

In addition, We will recognize goodwill from our investment in Daiwa Asset Management Co. Ltd. from Q3 FY2024. The definition of adjusted profit has been revised to add back the amortization of this goodwill.

| Adjusted profit | = | Net income | + | Adjustment of policy reserves | + | Amortization of goodwill |

Relate starts here.