Main Text starts here.

Corporate Information

Our Management Strategy / Growth Strategy

Our Vision and Medium-term Management Plan

In May 2021, JAPAN POST INSURANCE Co., Ltd. has formulated the Japan Post Insurance Medium-Term Management Plan (FY2021 – FY2025) which returns to our management philosophy of “Being a trustful partner for people, always being close at hand and endeavoring to protect their well-being,” and has been formulated based on our social mission that “We will remain trusted and selected by customers, thereby protecting their lives by providing life insurance product.”

Reviewed Medium-term Management Plan

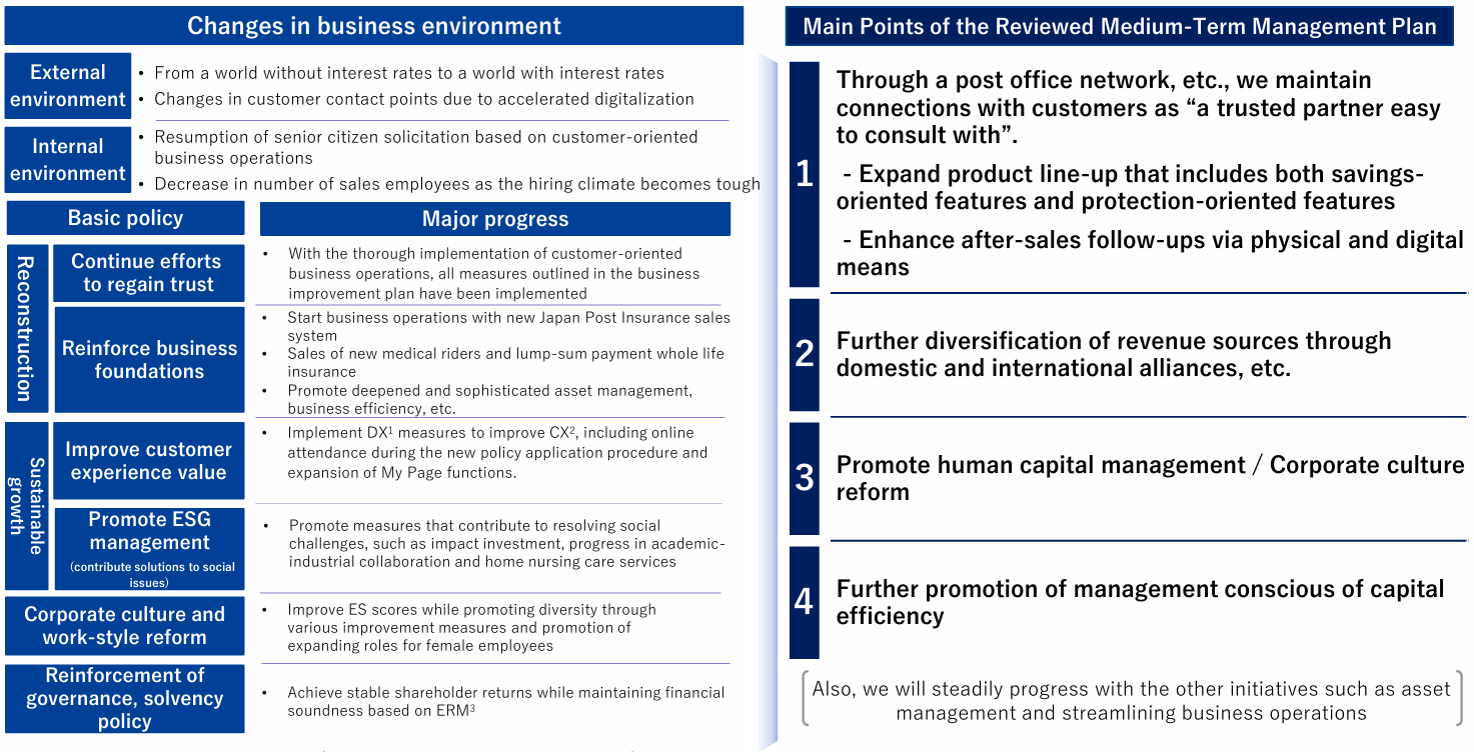

As three years has passed since the formulation of the Medium term Management Plan, we had reviewed it based on changes in the internal and external environments and our progress of the plan while maintaining the basic policies such as thoroughly implementing customer-oriented business operations.

※ For details of the contents, please refer to the linked documents below.

Concept of Reviewed Medium-term Management Plan

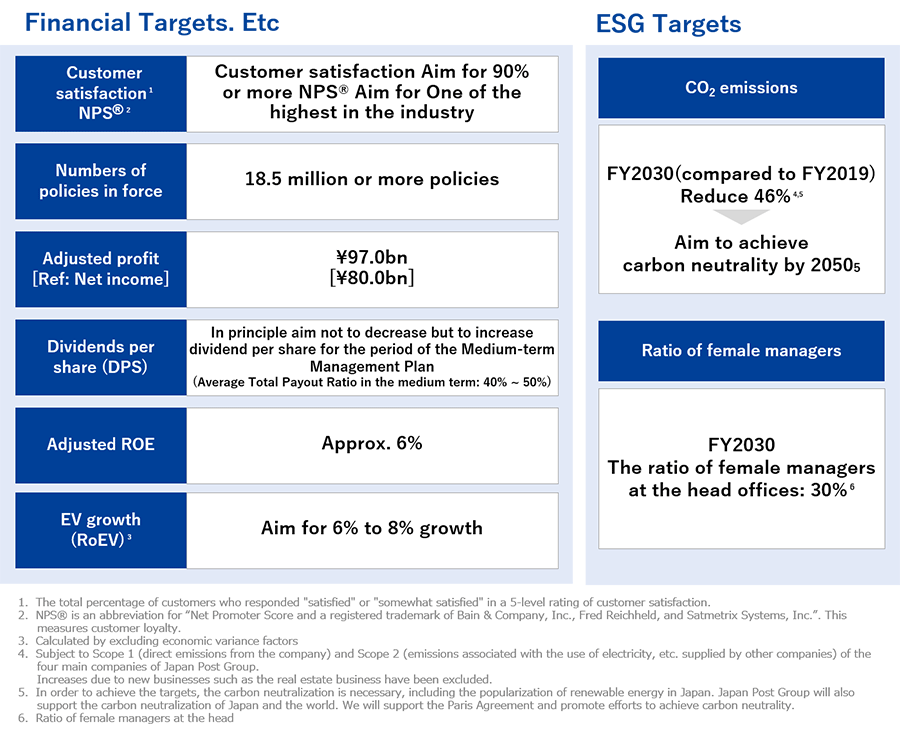

Primary Targets(FY2025)

We have reviewed our Financial Targets. For example, considering the characteristics unique to life insurance companies whose sales recovery has a negative impact on net income in the short term, we have been introducing “adjusted profit” that partially adjusts for such negative impact as a management target.

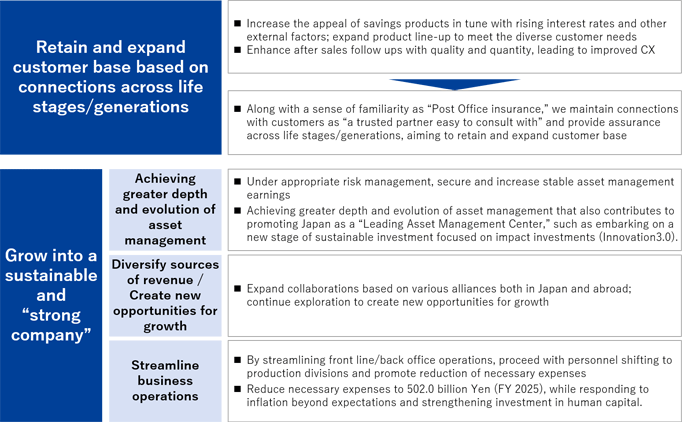

Growth Strategies

Sustainability Management

We has identified the following five materiality items (important issues) and promotes various initiatives in line with them in order to fulfill our social mission and address various issues related to sustainability.

Please see the linked documents below details about Reviewed Medium-term Management Plan.

Our Action to Implement Management that is Conscious of Cost of Capital and Stock Price

Last Updated: November 28, 2024

Regarding the Company's market valuation, the Company’s stock price still languishes at an undervalued level, with PBR around 0.3 times.

Additionally, with the earnings yield around the 7 to 8% level, we believe that the cost of capital demanded by the market deviates from the capital cost based on the CAPM, which is 6%.

Although the share price rose after the announcement of the upward revision of the financial results forecast and additional shareholder returns on November 14, the Company’s stock price remains underpriced due to concerns over the sustainability of the revised profits from next fiscal year onward.

Going forward, we aim to push down the capital cost demanded by the market and also improve the stock price to “a market capitalization of ¥2tn” as an immediate target by continually achieving levels of revenue and management efficiency that the market values through “growth strategies that leverage our strengths” and “management efficiency” and enhancing shareholder returns.

Please see the linked documents below for details.

Links:

Financial Results MeetingPlesase refer to the following page for JAPAN POST Group Medium-term Management Plan.

JAPAN POST Group Medium-term Management PlanRelate starts here.