Main Text starts here.

About Us

Our History

We introduce our history that develops in accordance with change of the times since Postal Life Insurance was born in 1916.

1916

Commenced Postal Life Insurance business

|

|

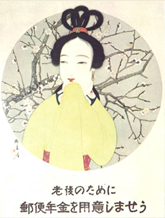

A poster advertising the first Postal Life Insurance |

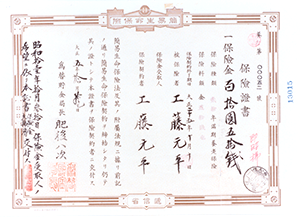

An original certificate for Postal Life Insurance |

1920

Established the Postal Life Insurance Bureau

| The Postal Life Insurance Bureau building |

|

1922

Opened the Postal Life Insurance Health Consultation Office

1926

Commenced the postal annuity business

Introduced a discounting system for advance premium payments

| A poster advertising the postal annuity |  |

1928

Commenced the National Health Exercise program (precursor of Radio Exercise program)

| People exercising under the Radio Exercise program |  |

1930

Introduced a system for exempting elderly insured persons from premium payments

1931

Introduced a system for discounting premiums with collective insurance

1946

Postal Life Insurance business ceased to be a government monopoly

1949

Established the Ministry of Posts and Telecommunications

Introduced the system for double payment of insurance benefits

1951

Established the Radio Exercise No. 1 program and broadcast on the radio

| Broadcasting the program |  |

1952

Established the Association of Postal Life Insurance Policyholders

Commenced distribution of surplus

1959

Launched family-type insurance

Established the Chuo Rengo Association of Postal Life Insurance Policyholders

1960

Established Incorporated Foundation of Postal Life Insurance Policyholders Association

1962

Established Postal Life Insurance Welfare Organization

1964

Launched double-type special endowment insurance

1969

Introduced accident riders

1971

Launched special whole life insurance and educational endowment insurance

| A poster advertising the educational endowment insurance |  |

1973

Established Postal Life Insurance Hall

1974

Launched individual term insurance

Introduced medical insurance riders

| A poster advertising the medical insurance riders |  |

1975

Launched fivefold-type special endowment insurance and group term insurance

1976

Launched asset formation savings insurance

1977

Commenced a networked service using the mechanized system of Postal Life Insurance Services

Revised the maximum amount of insurance coverage for Postal Life Insurance (from \8 million to \10 million)

Established a system for withdrawing the application for insurance contracts

1978

Launched adult insurance

1979

Introduced gender-segregated premiums / Reduced premiums by adopting Postal Life Insurance Experience Mortality Table

1981

Commenced the new postal annuity business

1982

Launched asset-formation endowment annuity and asset-formation whole life annuity

1983

Launched tenfold-type special endowment insurance

1985

Launched endowment insurance with pure endowments

1986

Commenced dividend for long-term contract continuation

Commenced automatic payment of insurance premiums through bank transfers

Revised the maximum amount of insurance coverage for Postal Life Insurance (from \10 million to \13 million under certain conditions)

1987

Launched husband-and-wife annuity / Launched a system for increasing policy amount

Launched husband-and-wife insurance / Revised the rider system (revised payment conditions, etc. for hospitalization benefits)

Commenced the payment of insurance and annuity benefits through postal transfer accounts

1988

Launched asset-formation housing funding insurance

Launched whole life insurance with nursing care benefits

Launched a lump-sum payment system for postal annuity premiums and immediate annuity

Introduced a discounting system for advance payments of and reinstatement system for postal annuity premiums

1989

Launched term insurance with pure endowments

Launched Japanese government bond-type endowment insurance

Established a rider system for postal annuity

1990

Launched endowment insurance maturing at a specified age

1991

Introduced the new postal life insurance system

Launched whole life insurance with whole life annuity

Revised the maximum amount of insurance coverage for Postal Life Insurance annuity (first-year annual premium: from \720 thousand to \900 thousand)

Commenced handling in-home payment of Postal Life Insurance annuity

Launched husband-and-wife insurance with husband-and-wife annuity

1992

Extended the upper age limit for enrollment (endowment insurance with 10-year maturity: from age 65 to 70)

Launched occupational insurance

Launched endowment insurance with pure endowments

1993

Improved the rider system (diversification of riders, expansion of rider coverage, etc.)

1994

Launched educational endowment insurance with scholarship annuity

1995

Launched whole life annuity with additional nursing annuity

Improved the emergency treatment system

1996

Launched fixed amount-type whole life annuity

Opened the "Kampo Website"

1997

Commenced special husband-and-wife annuity

Lowered the age limit by five years for enrollment of deferred whole life annuity

Commenced reduction of interest on loans (in case insured persons enter a state requiring nursing care, etc.)

1998

Delivered policy details to all policyholders

Commenced handling Postal Life Insurance Card

| Attendance card in commemoration of the 70th anniversary of the Radio Exercise program (participation form on the back) |  |

1999

Launched special endowment insurance maturing at a specified age

Expanded the maturity age for endowment insurance maturing at a specified age (from age 55-65 to age 35-65)

Commenced payment of insurance benefits through the bank saving accounts of certain private financial institutions

Commenced Minna no Taiso (“Exercise for Everyone”) program

2000

Commenced handling Postal Life Insurance Card using ATMs

Launched designated endowment insurance

2001

Creation of Postal Services Agency as part of realignment of government ministries

Established Japan Post Insurance Call Center

Commenced handling motorbike liability insurance

2002

Launched defined contribution whole life annuity

Consolidate the maturities of ordinary endowment insurance and special endowment insurance into maturity at specified age

Extended the upper age limit of policyholders for enrollment of educational endowment insurance and educational endowment insurance with scholarship annuity (from age 50 to 55)

2003

Established of Japan Post (abolishment of Postal Life Insurance Welfare Organization)

Improved annuity products (fixed-amount payment of annuities and launched whole life annuities with no limitation on insurance period)

Improved educational endowment insurance, etc. (lowered the age limit of policyholders for enrollment from age 20 to 18 for male and to 16 for female) / Launched the educational endowment insurance maturing at age 22, etc.)

2004

Improved whole life insurance (launched double-type whole life insurance and fivefold-type whole life insurance)

Improved special endowment insurance (expanded the maturity age for double-type special endowment insurance from age 70 to 75)

2005

Provide customer consultation service nationwide via Japan Post Insurance Call Center

2006

Commenced payment of insurance premiums through bank accounts of private financial institutions

Commenced the payment of insurance benefits through bank saving accounts of private financial institutions

Established Kampo Co., Ltd. under the Postal Service Privatization Act

2007

Postal service was privatized

Changed trade name to JAPAN POST INSURANCE Co., Ltd. in line with the commencement of the life insurance business

Started Postal Life Insurance management operations under commission from the Management Organization for Postal Savings and Postal Life Insurance

Obtained approval for new operations (liberalization of investment products)

2008

Commenced commissioned sales of life insurance products for corporate clients

Launched “Sono hi kara, a new hospitalization rider”

The logo of “Sono hi kara, a new hospitalization rider” |

2011

JAPAN POST INSURANCE SYSTEM SOLUTIONS Co., Ltd. (current consolidated subsidiary) became a subsidiary

2014

Launched “Hajime no Kampo,” an educational endowment insurance

Commenced handling commissioned sales of cancer insurance products for American Family Life Assurance Company of Columbus*

*Our current contract partner is Aflac Life Insurance Japan Ltd.

| The logo of “Hajime no Kampo” |  |

2015

Commenced sales of endowment insurance “Shin Free Plan (limited payment)”

Commenced commissioned sales of life insurance products for corporate clients (general welfare group term insurance, etc.)

Listed on the First Section of the Tokyo Stock Exchange

| Listing ceremony |  |

2016

Obtained approval for new operations (underwriting of reinsurance policies, related services)

Business alliance with The Dai-ichi Life Insurance Company, Limited*

Signed a trilateral memorandum with The Dai-ichi Life Insurance Company, Limited and Vietnam Post Corporation

100th anniversary of Postal Life Insurance

*Currently Dai-ichi Life Holdings, Inc.

| Signing ceremony of the memorandum |  |

2017

Commenced sales of “Sono hi kara Plus,” a new medical rider, “Shin Nagaiki Kun Low Cash Value Plan,” a new whole life insurance, and “Choju no Shiawase,” a longevity support insurance

|

|

|

The logo of |

“Shin Nagaiki Kun” |

The logo of |

2019

Commenced sales of “Kampo ni Omakase,” products with relaxed underwriting criteria; and an advanced medical rider

Secondary offering of common stock of Japan Post Insurance

|

|

The logo of “Kampo ni Omakase” |

The logo of “Advanced medical rider” |

2022

Commenced sales of “Motto sono hi kara Plus”, a new medical rider.

Moved to Prime Market of the Tokyo Stock Exchange.

The logo of “Motto sono hi kara Plus”, a new medical rider |

Relate starts here.